Digitalization is a stage of development that affects all spheres of the economy, business, moreover, digital technologies in the financial sector are gradually entering the life of every person. Recently, non-cash money has been increasingly used, every day a huge number of people pay for services and goods using payment cards in shops, in transport, in online stores. In the financial sector, the use of digitalization is also a modern approach to online cash management. With the help of bank cards, just as in the case of cash, you can perform the main functions of money: i.e. use them as a means of payment and savings.

JSCB “Halkbank” follows the path of continuous improvement of the services provided, an example of which is the experience of optimization of instant payment systems. One of the innovations offered by JSCB “Halkbank” has become the function of online registration of an application for obtaining a new card on the official website of the bank.

Individuals wishing to open a new card and become a client of the bank can submit an online application for consideration. When submitting an online application, you can receive a card of JSCB “Halkbank” in one visit to the office.

To start the procedure, just go to the official website of the bank www.halkbank.gov.tm and go to the section of the online application, in which you need to fill out the specified form.

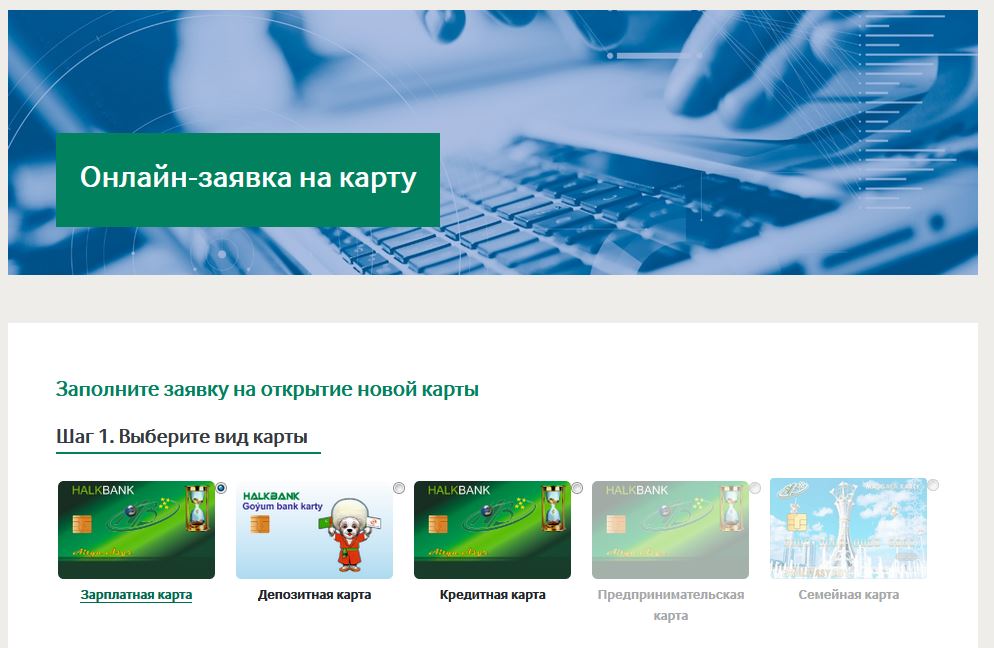

The process of registration of the card begins with the choice of the type of card and filling out the application form for opening.

To fill out an application, you need to indicate personal data, passport data, additionally attach a scanned copy of your passport and indicate the place of work.

Then you can proceed to the process of paying for the service. The cost of the card together with the PIN envelope is 23 manats. It should be noted that the application will not be considered without payment. The processing time will take a maximum of 2-3 days. To obtain a card, you must go to the bank office with a passport.

At the moment, three types of bank cards are available for registration:

Salary card.

Bank card to which the client's salary is credited. It is opened on the basis of an agreement between the bank and the company. This card provides a full range of services for non-cash payment in terminals, as well as receiving cash from ATMs in the territory of Turkmenistan.

Deposit card.

A bank card designed for demand deposits of cash from individuals credited to the customer's card account. The annual income on such a card is 6.8% on the balance with the possibility of replenishing the account. It is allowed to withdraw funds as well as interest at any time. The client can make non-cash payments using a deposit card, as well as withdraw cash from an ATM. At any time, on the basis of a written application, the client has the right to withdraw all invested funds from the card.

Credit card.

A credit card can be issued by a bank client who has been approved for issuing a consumer loan. This card is intended only for crediting credit funds and for making non-cash payments.

The Joint-Stock Commercial Bank of Turkmenistan “Halkbank”, in order to ensure reliable protection of funds, urges customers and users to comply with the following rules for using bank cards:

- Under no circumstances allow anyone to use a personal card

- The PIN code is classified information that is not allowed to be disclosed to third parties

- It is forbidden to write down the PIN-code on the card itself, as well as store information about the PIN-code along with the card

- It is forbidden to use someone else's card.

Full compliance with all of the above rules will ensure the safety of funds. Through these services, transfers in payment transactions - everywhere, securely and at any time of the day - must be credited to the recipient's account within minutes.

The introduction of an electronic product is intended to enhance the integration, innovation and competitive potential of the payments market and better match the changing digital habits of consumers.

Transformation into a digital economy allows citizens to access services and goods faster and easier.